Author | Lucía Burbano

Numerous nations are looking at a cash-free future. Online payments are increasingly common and the variety of possibilities for the bank are also on the rise with the emergence of new generations of mobile networks determined to push us into making the definitive transition from analog to digital

Compared to 4G, 5G offers three main advantages: greater bandwidth increasing data transmission speed; improved latency, going from 35 and 52 milliseconds with 4G to between 1 and 2 milliseconds with 5G; and the capacity to connect more devices without affecting the previous two. Technologically speaking, these features offer a vast number of opportunities for the banking sector.

5G Smartphones and the digital bank

The number of operations we perform, including banking transactions, using our smartphones is growing. During the first quarter of 2021, global sales of 5G smartphones** reached 133.9 million units,** 458% more than the same period in 2020. This means a considerable percentage of the global population has a device suitable for using the 5G bank.

During the confinement due to the Covid-19 pandemic, around 12% of the UK’s population -around 6 million people- downloaded their bank’s application for the first time, while branches closed down and call centers were packed. An example that can probably be transferred to other countries and which is significant: for millions of people, the main relationship they are going to have with their banks is via their smartphones. And they will not accept anything less than an exceptional digital service.

How does 5G affect financial services?

The rollout of 5G will transform the digital bank. How? Firstly, the increased speed that comes with the 5G network will enable financial institutions to execute more complex processes and with greater speed, minimizing waiting times when verifying the identity of new customers or monitoring loans taken out, among other procedures.

Secondly, it will improve the current performance of existing banking apps and websites since, functionality is not, in some cases, one of their strong points. This is key, since it is no secret that Fintech companies are rapidly catching up with traditional banks.

5G will also provide faster and simpler payment options, which will make mobile and digital payments even more attractive for the general public and for businesses, further boosting its use.

Benefits of 5G for banks

Available on all devices

The characteristics of the 5G network enable banks to integrate their services on a wide range of devices, including phones, wearables and even cars to improve the customer experience.

Hyper-personalization: tailor-made offers

5G will enable banks to deploy technologies including Artificial Intelligence and Machine Learning, capable of analyzing enormous amounts of customer data. This will allow digital banks to obtain more precise information about their behavior and measure their preferences in order to design real-time personalized offers.

Augmented Reality and Virtual Reality: the bank at home

5G, with its greater bandwidth and low latency, could also enable the use of Augmented Reality (AR) and Virtual Reality (VR) in the banking sector and provide an immersive experience for the customer. On the one hand, it can be used to provide virtual assistants and chatbots with improved audio, video and language processing capacities. And on the other, it will be able to provide extended or mixed reality scenarios and immersive experiences for customers.

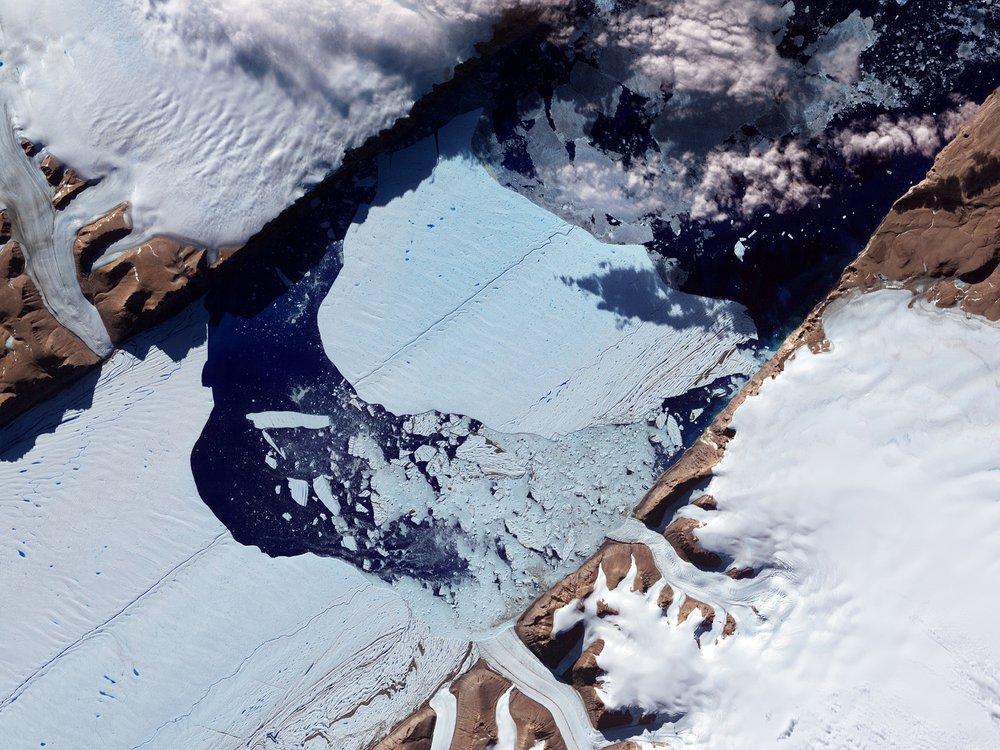

Better penetration in rural communities

The 5G bank will boost the much needed financial inclusion of rural communities, where access to physical banks is scarce or non-existent. On the other hand, in the coming years, practically everyone will have a device with 5G technology at their fingertips.

Is the 5G bank safe?

The capacity of 5G to connect to several devices and the speed of transmission of sensitive data may set off alarm bells regarding the potential risks of greater vulnerability. However, 5G will enable banks to improve their capacity to prevent fraud.

The greater speed and sophistication in the processing of data, the verification of the nature of transactions, the confirmation of transaction amounts and the ability to check substantial amounts of data in real time, together with the geolocation and identification of customers, will provide both consumers and the banks themselves with greater protection.

Photos | Unsplash/rupixen.com, Unsplash/Jonathan Cooper